Carbon Credits

What are the Carbon Markets?

Compliance Markets

- Participation required by certain industries by regulation. A cap is set on total emissions and the cap is reduced over time in order to reach climate goals.

- Carbon allowances are allocated and/or auctioned by the regulator and covered entities must retire enough allowances to cover their emissions.

- Prices driven by market fundamentals, regulatory factors and government imposed price controls.

- Examples include the European Union Emissions Trading System and the California Cap-and-Trade Program.

Voluntary Markets

- Participation is on a voluntary basis by individuals, corporations and organizations that want to offset their emissions.

- Carbon credits are created by projects that avoid, reduce or remove emissions beyond a “business-as-usual” scenario.

- Prices driven by market fundamentals and project specific attributes.

- The market for voluntary carbon credits hit a record US$1 billion in 2021 and could grow to a US$50 billion a year market by 2030, according to McKinsey.

What are Carbon Credits?

- A carbon credit is a tradeable unit representing one metric ton of greenhouse gas (GHG) that has been prevented from entering or removed from the atmosphere. GHGs are measured in terms of carbon dioxide equivalent (CO2e). It can be traded many times until it is ‘retired’ and used to offset a specific emission activity.

- The vintage refers to the year in which the emissions reduction or removal took place. Buyers often prefer vintage years that are the same or close to the year of the emissions it is being retired against. Buyers also sometimes seek projects that are located near the activity that needs to be offset.

- Positive impacts created beyond emissions reduction, referred to as “co-benefits,” can also add value to the price of a carbon credit. Co-benefits include activities such as protection of biodiversity or job creation and are often defined in terms of the United Nations Sustainable Development Goals that they address.

Carbon Offset Project Types

AVOIDANCE / REDUCTION

Avoided deforestation

Renewable energy

REMOVAL / SEQUESTRATION

Reforestation

Carbon capture and storage

What Defines a Quality Carbon Credit?

There are non-profit independent carbon standard organizations that set rules and requirements for carbon offset projects. They are responsible for the validation and registration of projects and the verification of reductions and removals of GHGs prior to issuing credits. Their registry systems track the issuance, transfer and retirement of voluntary carbon credits. These standards include the Verified Carbon Standard administered by Verra, the Gold Standard, the Climate Action Reserve and the American Carbon Registry.

Criteria for Voluntary Carbon Credits

Real and

Measurable

Calculated based on a credible baseline using an approved methodology and expressed in standard GHG metrics.

Additional

Project would not exist without the funding from credits and it reduces or removes emissions beyond a business-as-usual scenario.

Permanent

Emission reduction or removal must not be reversed. Buffer pools can be used to minimize this risk and account for reversals if they occur.

Avoids or Minimizes

Leakage

Should not lead to an increase in emissions elsewhere, or safeguards must be in place to monitor and mitigate any increase that occurs.

Verified

The emissions reduction or removal should be monitored, reported and verified by a credible third-

party verification system.

What Drives Demand for

Voluntary Credits?

Corporate Net-Zero

Pledges to Drive Demand

Transition Takes Time

Carbon credits can be

used to offset emissions

as a company implements

its decarbonization plan

Lower Cost of Capital

Companies with better

ESG scores tend to have

lower cost of capital than

their lower-ranked peers

Regulatory Pressure

Increased disclosure of climate-related

risk will force companies to

reduce and eliminate emissions

Hard-to-abate Emissions

Some industries (e.g. oil, aviation,

steel and cement) have emissions

that can not be reduced or

eliminated with current technologies

Shareholder Pressure

Investors have had recent

success with shareholder

proposals requiring

companies to address

climate change

Corporate Net-Zero

Pledges to Drive Demand

Hard-to-abate Emissions

Some industries (e.g. oil, aviation,

steel and cement) have emissions

that can not be reduced or

eliminated with current technologies

Shareholder Pressure

Investors have had recent

success with shareholder

proposals requiring

companies to address

climate change

Regulatory Pressure

Increased disclosure of climate-related

risk will force companies to

reduce and eliminate emissions

Lower Cost of Capital

Companies with better

ESG scores tend to have

lower cost of capital than

their lower-ranked peers

Transition Takes Time

Carbon credits can be

used to offset emissions

as a company implements

its decarbonization plan

Exponential Growth Expected

as Participants Increase

- Race to Zero campaign includes 3,067 businesses and 622 higher education institutions committed to net-zero by 2050.

- Glasgow Financial Alliance for Net Zero, which includes over 450 banks and asset managers representing US$130 trillion of assets, is committed to net zero by 2050.

- Two-thirds of companies in the S&P 500 have set targets to reduce GHG emissions.

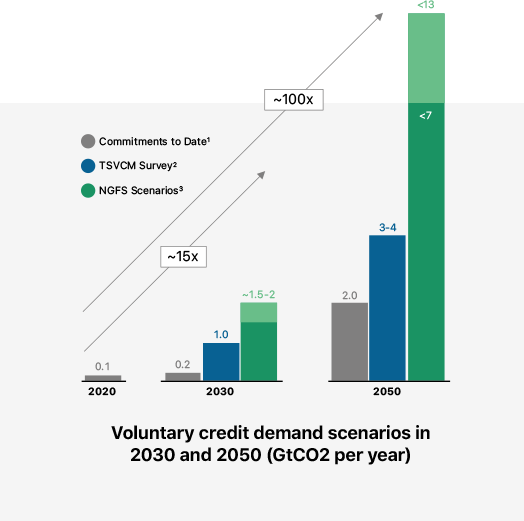

Demand for voluntary

credits could grow

by ~15x by 2030

and ~100x by 2050

Notes:

- Projected credits demand based on climate commitments of more than 700 large companies in 2020. They are lower bounds because they do not account for likely growth in commitments and do not represent all companies worldwide.

- Taskforce on Scaling Voluntary Carbon Markets (TSVCM): Projected credits demand envisioned by subject matter experts within the TSVCM

- Network for Greening the Financial System (NGFS): Amounts reflect demand based on carbon-dioxide removal and sequestration requirements under the NGFS’s 1.5°C and 2.0°C scenarios and is an upper bound in 2050 as it assumes that all removal/sequestration is supported by voluntary credits.

Sources: McKinsey analysis; NGFS; TSVCM